Business Insurance in and around Fargo

Looking for coverage for your business? Search no further than State Farm agent Tom Weber!

Helping insure small businesses since 1935

Insure The Business You've Built.

When experiencing the wins and losses of small business ownership, let State Farm be there for you and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, business continuity plans, and worker's compensation for your employees.

Looking for coverage for your business? Search no further than State Farm agent Tom Weber!

Helping insure small businesses since 1935

Get Down To Business With State Farm

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a pet groomer, a florist or an ice cream shop. Agent Tom Weber is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

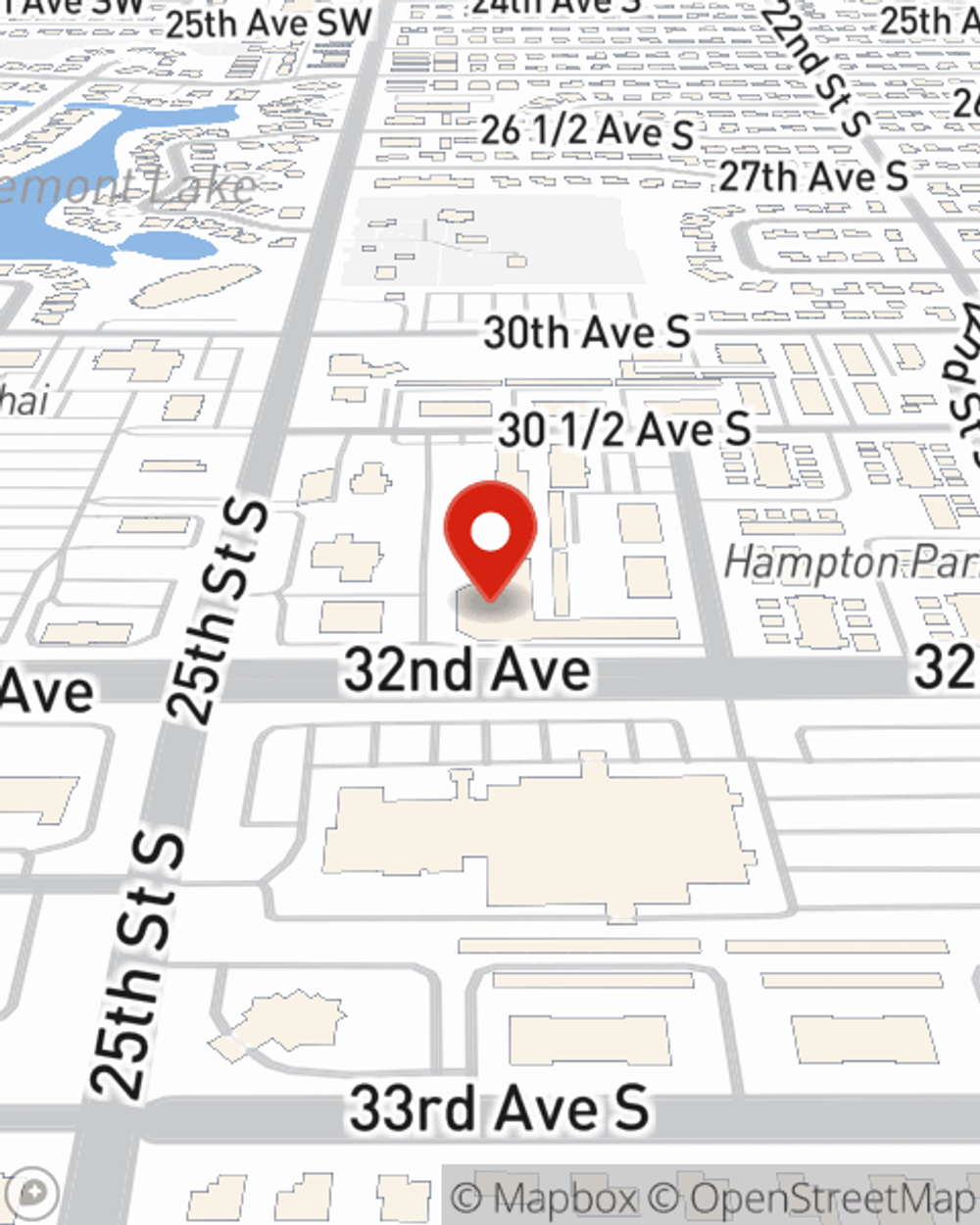

Agent Tom Weber is here to consider your business insurance options with you. Contact Tom Weber today!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Tom Weber

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.