Life Insurance in and around Fargo

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

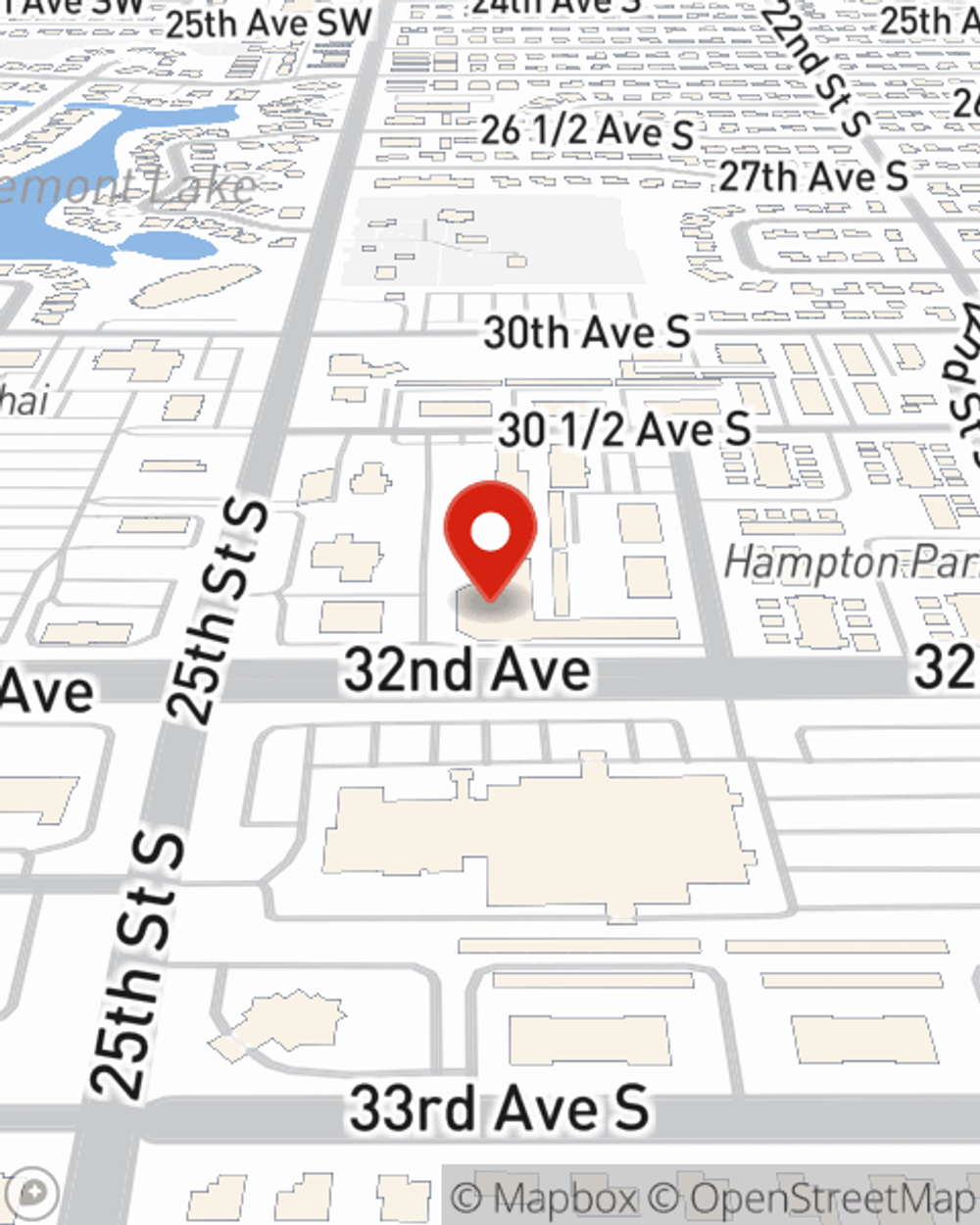

- Fargo, ND

- West Fargo, ND

- Horace, ND

- Moorhead, MN

- Dilworth, MN

- Glyndon, MN

- Williston, ND

Protect Those You Love Most

When it comes to excellent life insurance, you have plenty of choices. Evaluating providers, coverage options, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Tom Weber is a person who can help you generate a plan for your specific situation. You’ll have a hassle-free experience to get reasonably priced coverage for all your life insurance needs.

Insurance that helps life's moments move on

Life happens. Don't wait.

Put Those Worries To Rest

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you choose can be designed to fit your current and future needs. Then you can consider the cost of a policy, which depends on how old you are and your health status. Other factors that may be considered include lifestyle and family medical history. State Farm Agent Tom Weber can walk you through all these options and can help you determine what will work for you.

To find out your Life insurance options with State Farm, reach out to Tom Weber's office today!

Have More Questions About Life Insurance?

Call Tom at (701) 356-4080 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.